$2500 MMR Without a Product

MRR is the name of the game in the world of indie hacking and micro-saas. Grow your MRR and escape the corporate world — that’s the implicit motto of our community.

Whether this is a good north star or not (a topic for another post), I wondered what would happen if I applied the same lens to another part of my life: my journey toward financial independence.

Since November 2021 I have embraced a philosophy of living well below my means in order to save and invest a large part of my personal income. I have done so to varying degrees of success. But the overall trend is clear — I have saved a ton more than I would have otherwise. And as far as I can tell, my life satisfaction has not decreased one bit (I could have saved more, but there is a balance and I’m still learning).

Save and invest

In a decent, normal month my savings rate has been around 60%.1 This means I save and invest 60 cents for every dollar of personal income (after taxes and benefits, meaning the money that is wired to my bank account).

Without revealing my exact pay, let’s say I end up with a $50k inflow to my bank account a year:

($50000 / 12) × 60% = $2500.

That’s $2500 a month. If I “only” made $40k the monthly saving would be $2k. And if I make $60k it would be $3k.2

Personal monthly recurring revenue?

At this point I can hear some loud objections. What do savings have to do with monthly recurring revenue (MRR)?

Well. One trend in the indie-hacking world is to focus solely on MRR (which reveals only a small part of the bigger picture). Another is to view yourself as a “personal holding company”. This one I like a bit more as it aligns with a focus on wealth creation. Without taking the analogy too far, my goal is to own income-producing assets.

In one sense, the MRR of Me Inc would be ($50000 / 12) = $4166. Or to really boost the numbers I should take my pay before taxes, benefits, and other costs. $10k MRR here we come!!

But I don’t buy those inflated numbers. I’m trading time for money and that is not a viable way to build wealth. The $2500 MRR story I do buy. Why? Because it is not a time-for-money trade. It is a living-below-your-means-for-money trade. And living below your means does not cost time. In most cases, it does the opposite — it saves time (can’t mow a big lawn if you don’t have one).

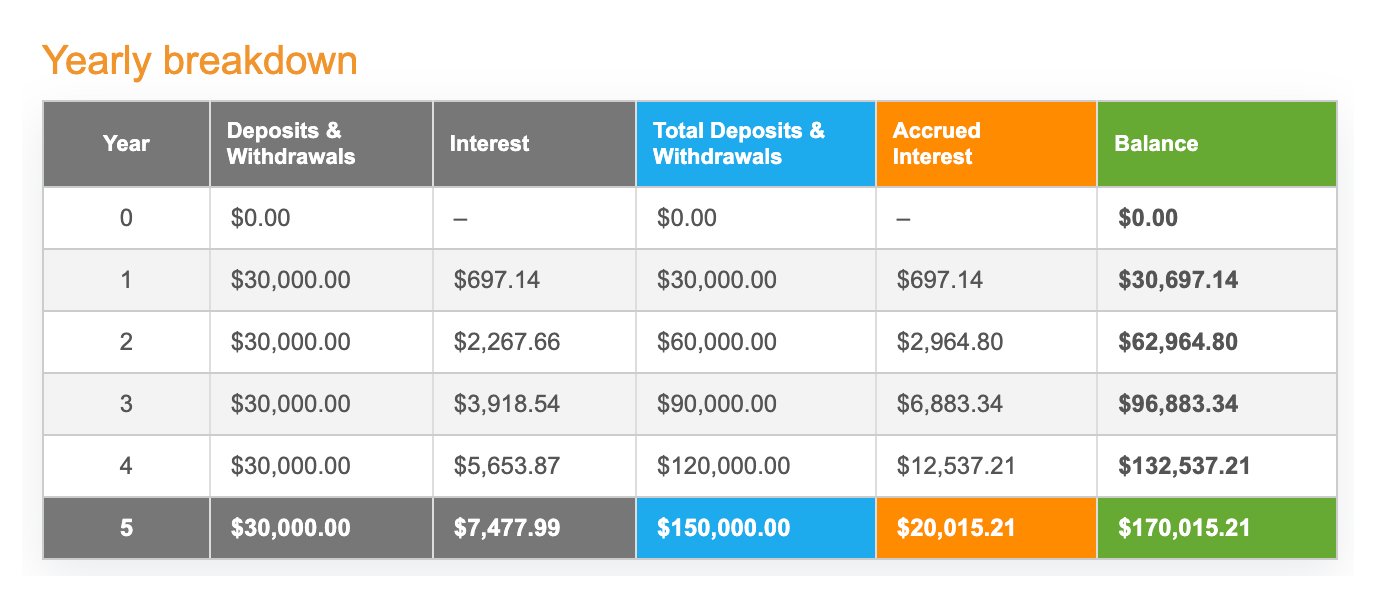

What’s more, these $2500 are revenue into Me Inc — a company that has no expenses (as they are already taken care of). So that’s $2.5k in profit every month. A profit I invest with a long-term horizon. With compounding interest that means another $20k of interest in 5 years:

Spread out over 5 years:

$20000 / (12 × 5) = $333

It adds another $333 to the MRR for a total of $2833. With a 10-year horizon the interest becomes $88,205 and the MRR $3235.

These numbers are synthetic. If at any point I stop working, my MRR grinds to a halt. The money invested in our scenario is still so small that the interest depends on additional deposits to really grow.

But is a small indie website really that different? Sure, we dream about passive income from a business that is humming along, hands-off. But how realistic is that dream? First, you have the (massive) hurdle of creating something people want to pay for (product-market fit). And if you succeed at that, you have operations, support, marketing, and other struggles I don’t even know about.

Beat all that and you may have a business that runs with little intervention on your part. But for how long? Markets (really the entire world) are changing rapidly. Even if you have stable SEO traffic from Google, who is to say the next update won’t mess all that up?

The perspective I’m trying to take is this: if you dream about another $2500 MRR to beef up your budget, it is much easier to reduce your expenses than it is to build a business generating that much. And you can do it right now, starting today.

FI(RE)

All of the above is a long-winded way of me telling you to check out something called FIRE. Financial Independence, Retire Early. Skip the retire early and any other bad connotations you may have about this “movement”. I’m just interested in the ideas about financial independence.

I first joined this rabbit hole in October 2021 and I’m so glad I did. You can read the start of my journey here. Since then (just two years) I have invested more money than I will probably ever make as an indie hacker. Not only that, I have learned to live well below my means so my threshold for financial independence is now lower.

Indie hacking

If you want financial independence, indie hacking is one way of achieving that, reducing your expenses and investing the difference is another. That is my core argument in this post. In addition, based on personal experience, I believe reducing your expenses is a simpler and more predictable way of achieving this goal.

You may get lucky with indie hacking. Saving and investing won’t get you to $10K MRR in a few years (unless you invest in something risky). Indie hacking may (but most likely won’t). The potential is there, but you could also spend years and have nothing to show for it in terms of wealth.

I’ve come to this conclusion after trying to build a couple of websites and realizing that maybe this isn’t for me. I’m not good with uncertainty and I don’t particularly enjoy marketing. But I freaking love building, creating, and writing. That’s why I joined in the first place. And it’s why I’m not leaving just yet.

But through this lens I’m less stressed about monetary success of any project. Truth is, I already have enough (most of us do). Instead, I’ll focus on things that make me happier (such as creating). And I will revive on other areas of my life that need attention.

Indie hacking can be so much more than just money. It is a community. It is a lifestyle — an excuse to build cool things. That’s why I’m still here. Hacking away. But in the background I still have a job. A job that I quite frankly enjoy. I’m using my paycheck to grow a nest egg. Just in case this indie hacking thing doesn’t make me a millionaire next month.

Footnotes

-

A note on my personal income: the figures may be off if you are living in a country that has different taxation and benefits. In Denmark we pay quite a bit to the government but get a lot in return. But in the end, the important number for our discussion here is how much money you can put aside each month — after everything is paid for. ↩