Attempting to understand AMPL and SPOT

The last few days I’ve been down the crypto rabbit hole.

This time trying to understand Ampleforth.org’s attempts at creating a “elastic finance ecosystem, a decentralized financial infrastructure powering innovations in money”.

I like what they are cooking. But I don’t fully understand everything.

The following are my notes and thoughts - me trying to understand. Some of this may be wrong.

AMPL - ‘The decentralized unit of account’

AMPL is supply and demand driven just like many other tokens. The difference is that most tokens have fixed supply and so what changes is price.

More demand -> higher price. Less demand -> lower price.

That is how supply and demand works when the supply is fixed. We are pretty used to this. E.g., the stock market has a fixed supply of stocks per company.

AMPL differs in that supply is not fixed. Instead the supply is driven by an algorithm that attempts to target a stable price. The price target is a CPI adjusted dollar - meaning AMPL price attempts to track the inflation adjusted dollar.

We can attempt to understand AMPL from:

- Supply

- Demand

- Price

Normal token/coin: (e.g., Bitcoin)

- Supply: stable

- Demand: varies

- Price: tracks demand

AMPL:

- Supply: tracks demand

- Demand: varies

- Price: stable (the price can (and does) vary but the algorithm attempts to bring it back to CPI adjusted dollar)

To me this means investing in AMPL is similar to many other tokens: you should invest if you believe demand will increase. The main difference you’ll see is that it is not the price that will change in your wallet - it is the number of AMPLs you have. (This is also what makes AMPLs so strange - you can’t do this in the “real world” as the number of tokens in your account literally changes on a daily basis).

SPOT - ‘A low volatility store-of-value that makes no compromises on durability or decentralization’

SPOT is built on AMPL. AMPL is volatile - the value tracks demand. SPOT tries to use AMPL to build a token that is more stable.

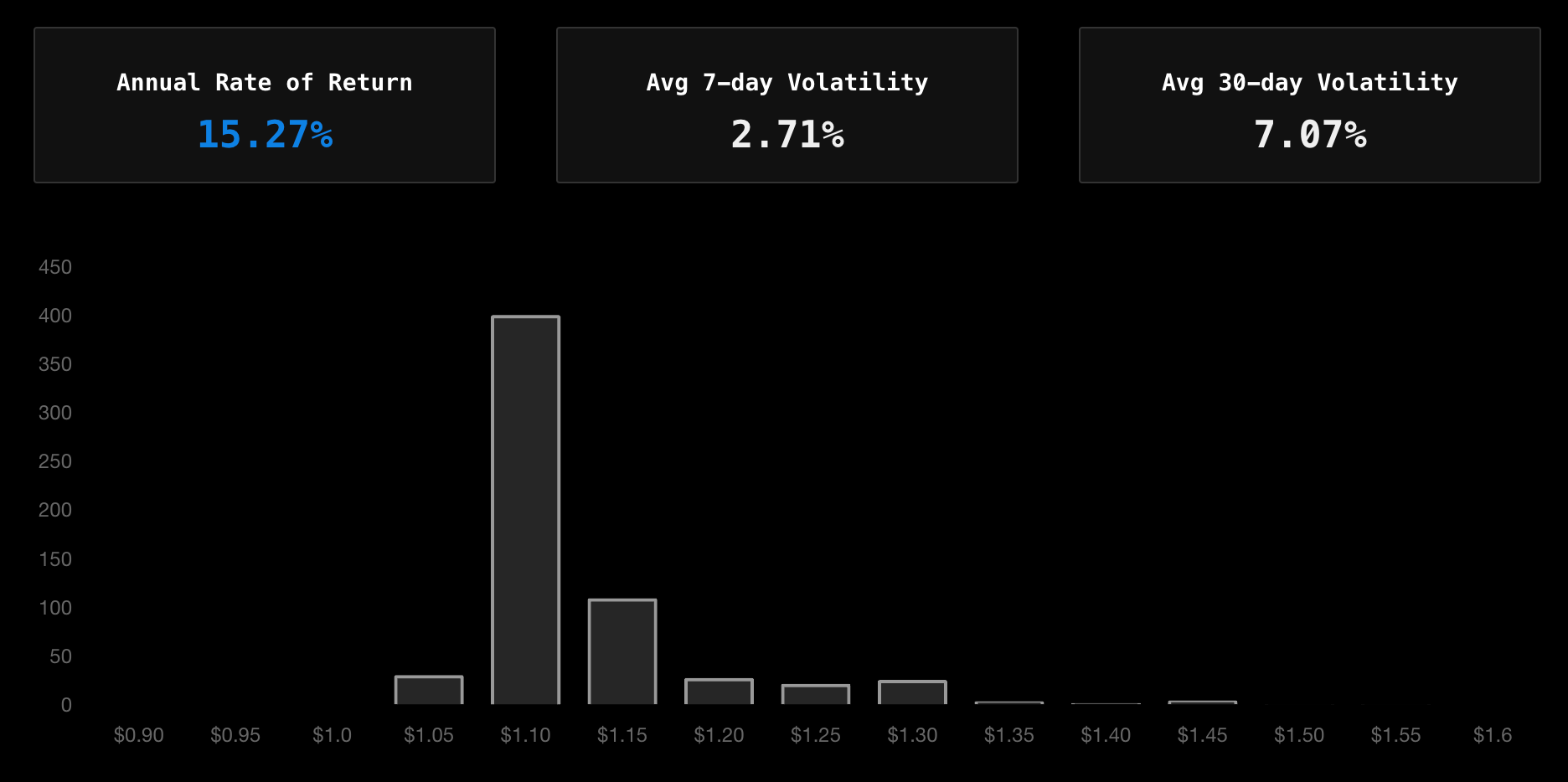

If everything works, the SPOT token tracks CPI. But market conditions may cause it to fluctuate a bit:

The investment thesis for SPOT is to preserve value and protect against inflation. It is a store-of-value with low volatility and high durability and decentralization (provided everything works).

As you may have noted in the image above, SPOT has a 15.27% annual rate of return right now. This is due to a fee mechanism in the protocol that incentivizes capital to keep the token stable. The way it works is a bit complicated but the fee is a based on demand for either SPOT (representing stability) or a byproduct of the protocol called stAMPL (representing volatility/leverage).

The return on SPOT can be positive as it is right now - but the fee can also go the other way if there is more demand for stability. So the return can be positive or negative depending on market conditions.

The fee mechanism means SPOT is a low-volatility investment with potential for positive or negative yield.